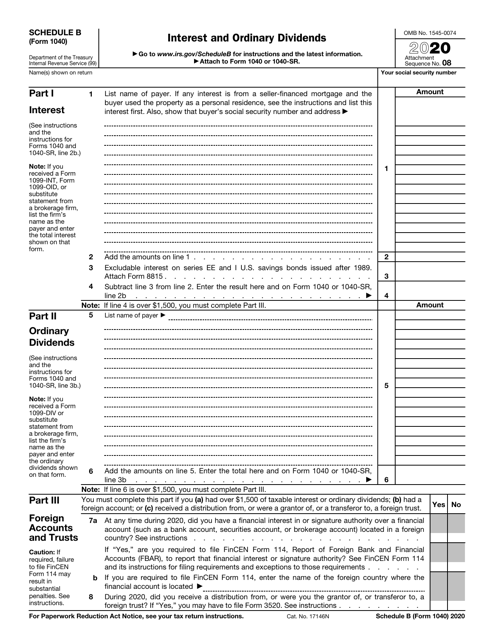

In terms of income levels, the IRS in recent years has audited taxpayers with incomes below $25,000 and above $500,000 at higher-than-average rates, according to government data.

That's why Collins recommends taxpayers ensure the income they report on their returns is consistent with the income that's stated in official income tax documents like a 1099 or W-2. Sometimes returns are selected at random for a closer review.Ī lot of audit notices the IRS sends are automatically triggered if, for instance, your W-2 income tax form indicates you earned more than what you reported on your return, said Erin Collins, National Taxpayer Advocate at the Taxpayer Advocate Service division of the IRS. When you're audited by the IRS, it means your return was selected from a batch of returns for a closer inspection. In both instances, just make sure you mark your contributions for the 2022 tax year.

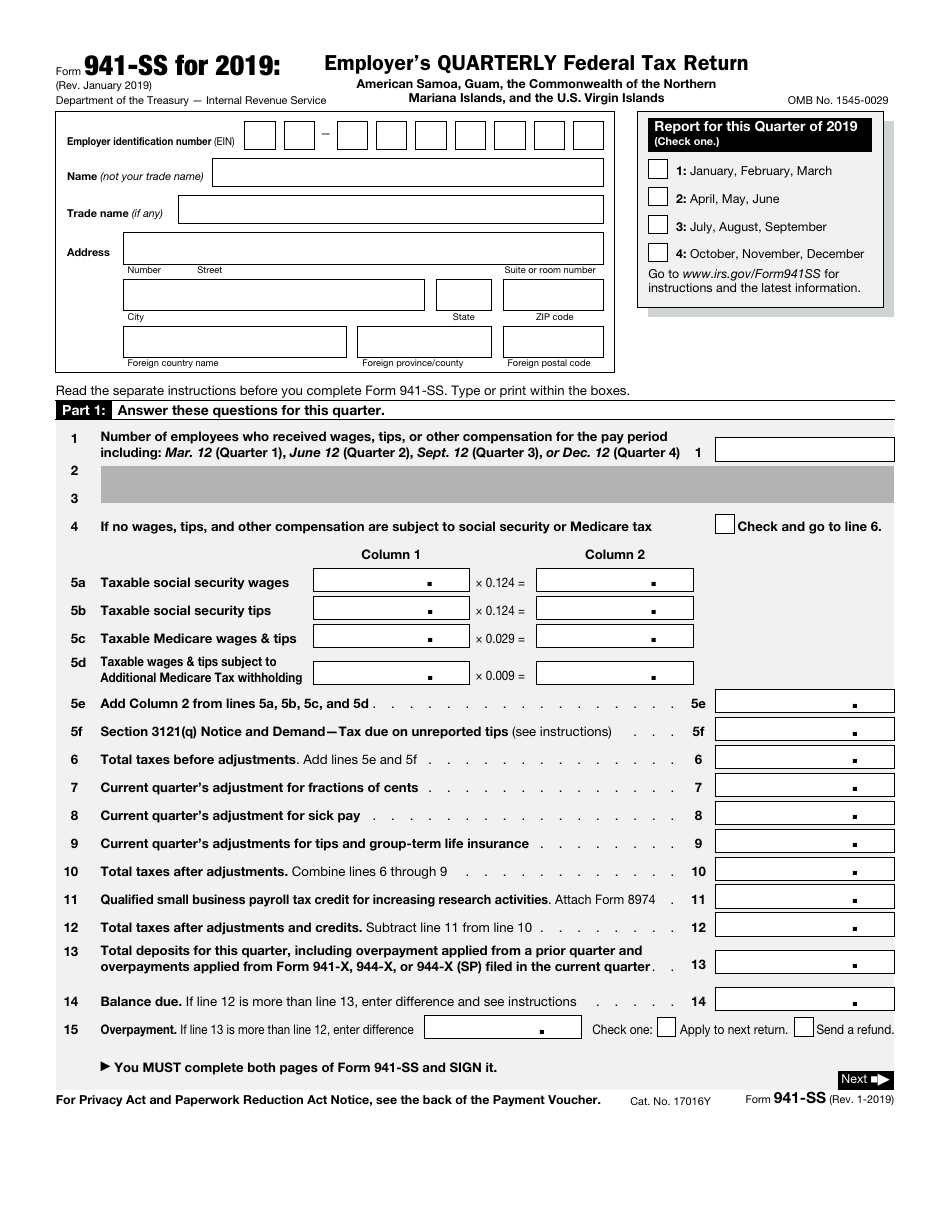

Total combined contributions for both traditional and Roth IRAs are capped at the smaller of $6,000, or $7,000 if you’re age 50 or older by the end of the year or your taxable compensation for the year, the IRS said.įilers may also add funds to their health savings account (HSA), if they are eligible for one, to count toward 2022. What is the tax year deadline for IRA contributions?Īlong with tax filing and first quarter estimated tax payments, Tuesday’s also the last call to contribute to your IRA for a 2022 tax deduction unless you live in an area that was granted a filing extension by the IRS. If you fail to pay taxes on time, the penalty is 0.05% of unpaid taxes for each month you don't pay, with a 25% cap. And that doesn't count any additional state penalties. According to the IRS, the "Failure to File" penalty is 5% of unpaid taxes for each month you don't pay, but it won't exceed 25%. Taxpayers who don't file by the deadline face hefty penalties. – Elisabeth Buchwald What happens if you don’t file taxes on time? Taxes are due by April 18 since April 15 falls on a Saturday and Emancipation Day, a holiday observed in Washington, D.C., is April 17. Here's everything you need to know if you still haven't filed your taxes: When are taxes due? The lower refunds are partially attributed to the elimination of key credits available to taxpayers last tax season. The average refund to taxpayers is $2,878, down from $3,175 at the same time a year earlier. holiday on Monday, the filing deadline was pushed to April 18.Īs of April 7, the Internal Revenue Service has processed more than 101 million returns. Tax Day is typically April 15, but because that date falls on a Saturday, and due to a Washington, D.C. It's time to file your taxes.Īpril 18 marks the deadline for taxpayers to file their annual returns.

0 kommentar(er)

0 kommentar(er)